A lot of thought and planning goes into one’s retirement as it is a time to sit back and reap the benefits of your investment during your working years. These days regular retirement investments and IRAs are becoming unstable with the ever-changing economy. As a result, most folks are turning their attention to precious metals IRA.

Precious metals such as gold as well as silver metals resource are regarded as more stable forms of investment and great for long-term investments. While precious metals IRA are becoming more popular by the day, the details of the whole thing still seems a bit sketchy to a lot of folks.

Therefore, in this article, we will guide you on what this form of investment is all about while providing you with the right information that you need to know.

Let’s begin, shall we?

What a Precious Metal IRA is

This is a distinct type of self-directed IRA (individual retirement account) whereby you can invest in precious metals. For you to do this, you will need to hire the services of a precious metal IRA custodian.

Many individuals have chosen this form of retirement plan as a means of protecting their wealth by reducing possible investment risk and volatility, having a hedge should an economic downturn occur, and a way of sheltering their assets from certain tax issues.

How Much Precious Metals should you invest in your IRA?

While this form of investment seems pretty incredible, financial experts advise that you invest carefully. Most financial experts agree that you shouldn’t invest more than 10% of funds reserved for your retirement. The percentage you should invest in is also determined by your current financial situation.

The reasons for this seemingly low investment percentage are genuine. The first reason is the financial risk of investing in one particular asset. A good financial advisor will not advise you to put all your retirement eggs in one basket. Visit https://www.investopedia.com/articles/personal-finance/050815/what-do-financial-advisers-do.asp to learn what a financial advisor does. You could easily run into problems if you follow that path. Instead, you will be advised to diversify your portfolio.

Furthermore, although precious metals tend to retain value over time, their performance level is not as high as that of some assets; for example, stocks. Hence, it is possible for one to end up shortchanging themselves by having too many of these precious metals. The best option will be to invest in those assets that will generate more returns while holding a handful of this special IRA form.

One of the reasons a lot of folks opt for this form of investment is because these metals are regarded as “safe havens” from inflation. Nevertheless, they aren’t as stable as they seem. They are also volatile and unusually subject to the stocks market rise and fall. Gold and silver tend to rise then stocks fall, and then fall when the stocks rise. This doesn’t seem to portray the kind of stability that these items have been painted to have.

If you are seeking a more stable investment and hedge against inflation, then you should think of TIPS (Treasury Inflation-Protected Securities) or high-quality bonds. They provide better inflation security and hedging.

Precious Metals you can have in your Individual Retirement Account

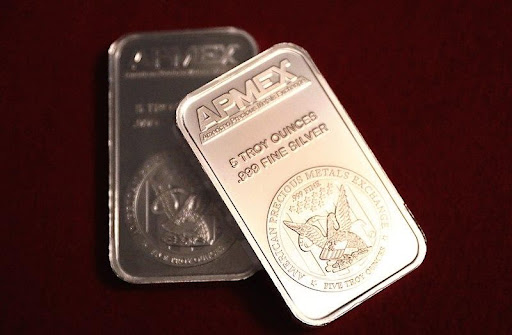

The commodities you can have in this kind of individual retirement account include gold, silver, platinum, and palladium. However, there are certain requirements these commodities must meet as set by the IRS before they can be accepted as IRAs. Click here to learn more about the IRS mission and its statutory authority.

The requirement has to deal with the purity level of these commodities. Gold has a purity requirement of 99.5%, silver 99.9%, platinum 99.95%, and palladium 99.95%. If your precious metal doesn’t meet these purity levels, it won’t be accepted.

Some products that are acceptable because they meet the required criteria are Australian Koala bullion coins, PAMP Suisse bars, and Canadian Maple Leaf coins. A gold product that doesn’t meet the requirement but is still accepted by the IRS is the American Eagle coin.

Collectible and rare coins such as British Sovereigns, German Marks, and Swiss Francs cannot be held in your IRA.

Should you have a Precious Metal IRA?

This form of investment is a worthwhile alternative for investors that are bothered by market volatility and inflation. Nevertheless, one must put into account that fact investing in a precious metal individual retirement account can be more expensive when compared to a good number of other forms of investment. Furthermore, they might be riskier than regular IRAs.

The individuals who are advised to go into this type of investment by their financial advisors are those who already possess a robust portfolio and would like to diversify. Hence, they can then invest a part of their funds into these precious commodities.

An alternative to investing in these commodities without having this special IRA form or be saddled with the necessity of getting a custodian, a dealer and depositories is to have investments in mutual funds or Exchange-Traded Funds (ETFs).

With these, you get alternative assets exposure but without the risk and less cost of having them in a precious metal IRA.

The bottom line about having a precious metals IRA is that it shouldn’t be your entire investment strategy but just a part of it. That way, you can get to expand your portfolio to other assets while growing your wealth on different fronts.

Conclusion

Investing for your retirement is a worthy venture and having a precious metal IRA is just one of the options you can choose from.