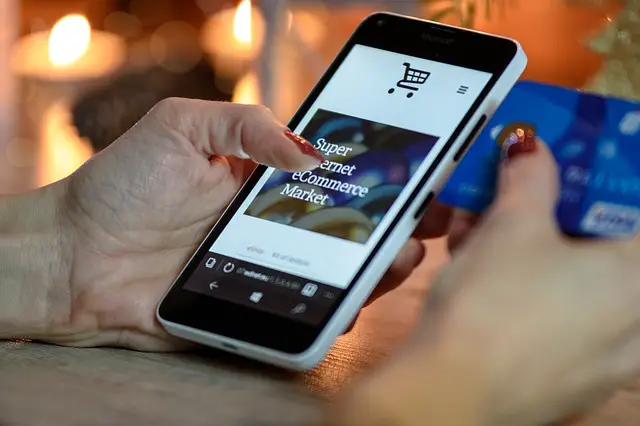

Save Money on Holiday Credit Card Interest

If you were counting on a holiday bonus or tax refund to pay off your holiday charges, you may not be able to. According to Hewitt Associates, 63% of companies surveyed don’t plan to give holiday bonuses this year. Due to the credit crunch, many businesses that previously offered bonuses have had to forgo them …